For any solo or small developer looking to launch a new product, the first critical step is robust market research. The mobile market presents a classic dilemma: do you enter the crowded, high-value games business or the rapidly growing, high-utility apps business?

To answer this, we adopt a top-down analytical approach, breaking down the market opportunity by size, growth, and the statistical probability of success.

Research Methodology Summary

All data for this analysis is provided by AppMagic and reflects key metrics across the global mobile market.

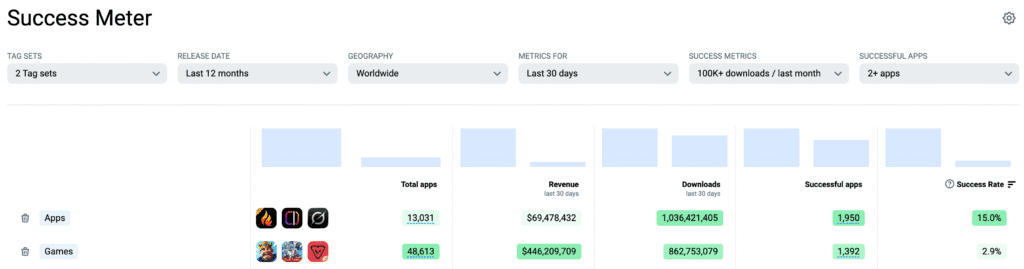

Our core metric for assessing risk and opportunity is “Success Rate,” which is defined as the number of apps or games reaching either a specific download or revenue threshold out of all globally launched titles in that category within the last 12 months. This data was obtained from the “Success Meter” tool in AppMagic

For this analysis, we use two thresholds for success:

Download Success: ≥100,000 downloads in the last 30 days.

Revenue Success: ≥$100,000 IAP net revenue in the last 30 days.

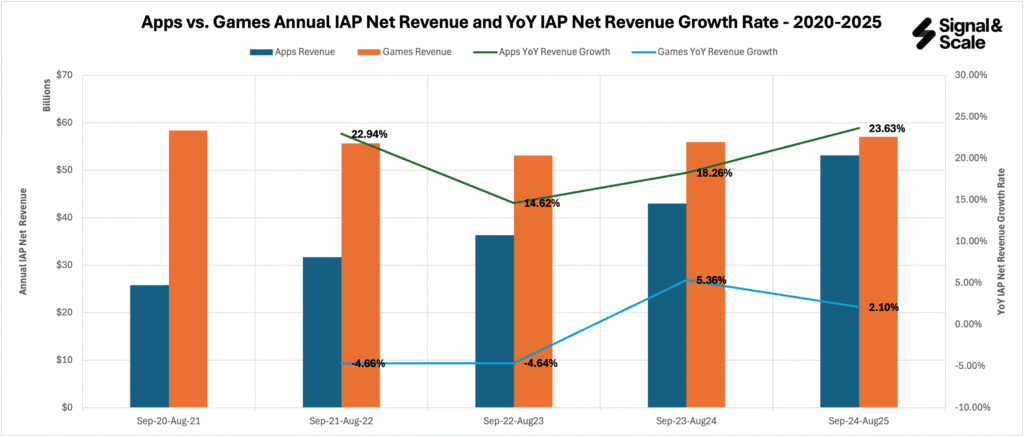

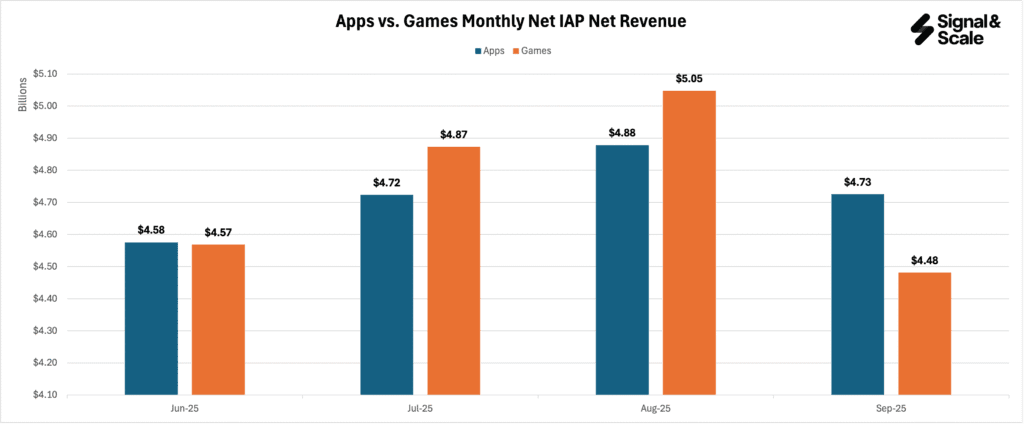

The Macro Revenue Opportunity

We begin by analyzing the overall total IAP revenue opportunity in apps versus games and the revenue growth of each category to determine the strategic direction of the market.

Analysis: While games still command the majority of the market’s IAP net revenue, the narrative is shifting dramatically. The monumental growth rate of the Apps category suggests a rapid market correction. The apps market is aggressively closing the revenue gap, driven by subscription models and utility value.

Key Takeaway: The Apps market is no longer a second-tier revenue opportunity; its growth profile suggests it is rapidly becoming the dominant investment space.

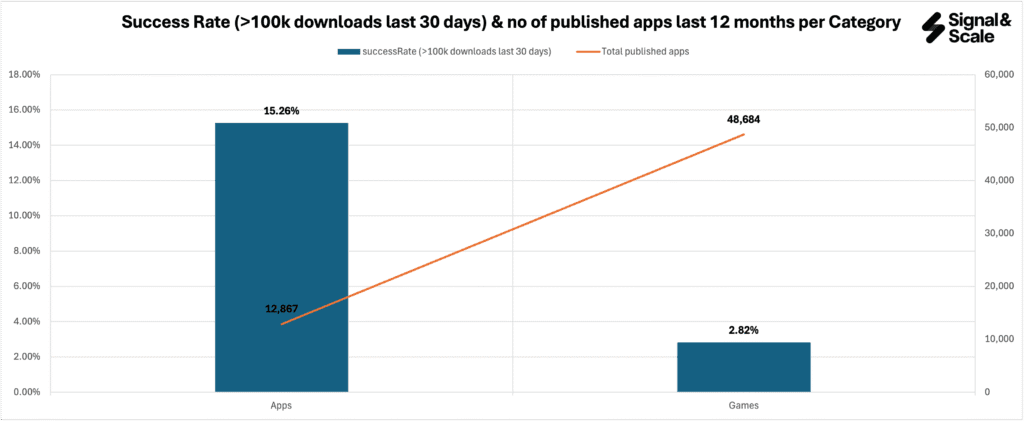

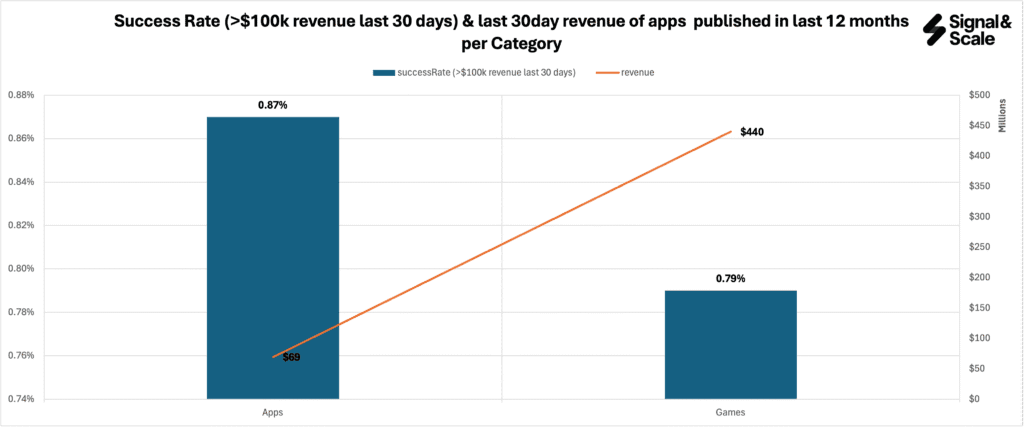

The Probability of Success

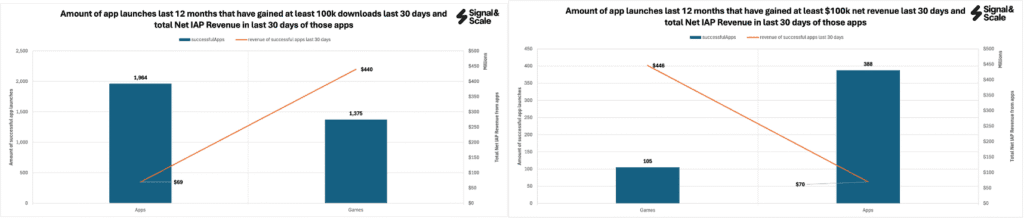

Beyond market size, a solo developer must prioritize the probability of gaining initial traction. This section analyzes the relative risk of entry for both markets.

Analysis: The difference is eye-opening. A potential reason is the sheer volume of new games launched globally in the last 12 months (∼48,684) compared to apps (∼12,867). For a new launch, the apps business offers a statistically much cleaner path to the 100k download milestone.

Analysis: The probability of striking IAP gold is low everywhere, but the marginal advantage still lies with Apps. The data confirms that in both download and revenue success rate, the apps market provides a higher probability of clearing the hurdle for a new launch.

Key Takeaway: Hitting the download milestone is achievable for many, but the real financial engine of the apps business and games business is powered by the small number of products that achieve high recurring revenue.

Micro Market Analysis: Category Deep Dive

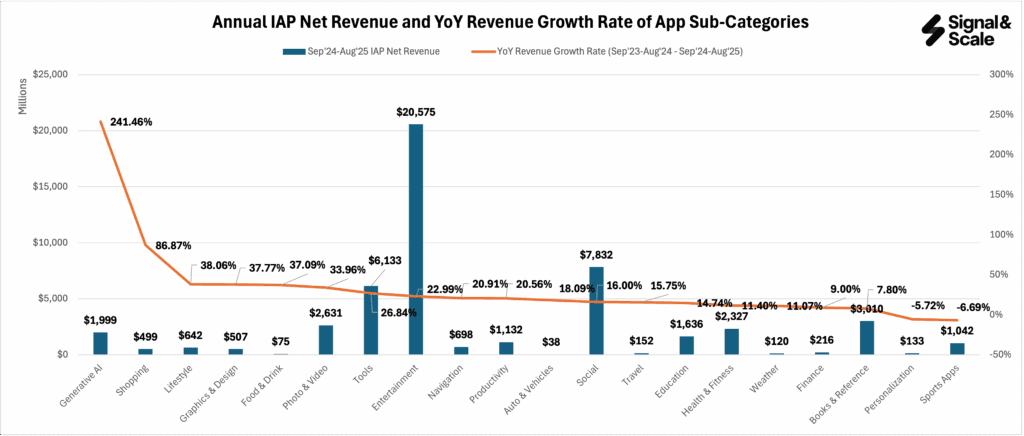

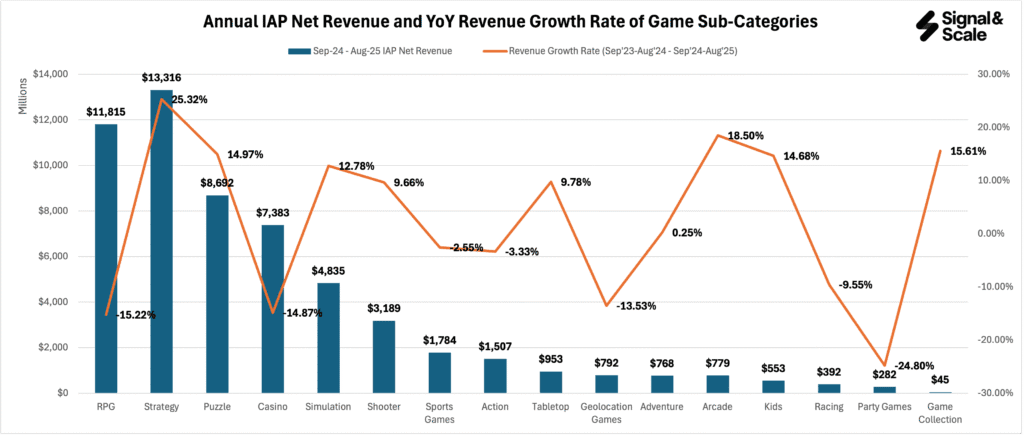

Adopting a final layer of research, we move to category-specific data to identify the hottest segments for investment.

| Focus | Top Performer | Key Insight |

|---|---|---|

| YoY Revenue Growth | Generative AI (241.46%) | This category is experiencing an unprecedented surge in monetization, indicating high user willingness to pay for modern AI utility. |

| Total Annual IAP Net Revenue | Entertainment ($20.575 Billion) | This category remains the largest in sheer volume, driven by high-value, long-standing subscriptions and content. |

| Download Success Rate | Navigation (30.77%) | Navigation, News & Magazines (21.95%), and Entertainment (17.83%) offer the highest statistical chance of gaining a large user base quickly. |

| Revenue Success Rate | Generative AI (2.86%) | AI and Social (1.77%) have the best odds for a new app to clear the ≥$100k monthly revenue threshold. |

| Focus | Top Performer | Key Insight |

|---|---|---|

| YoY Revenue Growth | Strategy (25.32%) | Core genres like Strategy and Arcade (18.50%) show strong vitality, contrasting with the slower growth of the overall Games market. |

| Total Annual IAP Net Revenue | Strategy ($13.316 Billion) | Strategy and RPG ($11.815 Billion) dominate the total market value, confirming the consistent profitability of deep meta gameplay. |

| Download Success Rate | Action (7.66%) | Action and Racing (6.18%) have the best chances for generating meaningful downloads, reflecting mass-market appeal. |

| Revenue Success Rate | RPG (5.60%) | RPG is the best segment for revenue success. It offers the highest statistical chance by far for a new game to clear the ≥$100k revenue threshold, indicating high LTV (Lifetime Value). |

Conclusions for the Investor

For the solo developer or small company without significant budgets performing this initial market research, the data presents a clear strategic trade-off:

- The Apps Business Strategy (Growth & Visibility): If your goal is to minimize risk, maximize early-stage downloads, and align with the market’s fastest-growing trend, the Apps market, particularly Generative AI and Navigation, is the superior choice. This path offers a higher statistical probability of achieving both download and revenue benchmarks for a new launch.

- The Games business (High-Value IAP-focused Niche): If your goal is to target the absolute highest concentration of revenue success probability, you must enter the high-investment, high-reward RPG category. However this genre requires big big budgets (usually more than $100M development budgets) so these are mostly out of the question for smaller developers.

- The Games business (Rapid Download Strategy with hybrid monetization): Alternatively, a solo developer with smaller development budgets and a focus on faster time-to-market might consider download-heavy niches like Action or Racing games. These games monetized with hybrid monetization strategy However, this strategy carries a higher competition risk due to the sheer volume of games launched globally.

Choosing between the Apps vs. Games market is fundamentally a choice between high growth and lower entry risk (Apps) or high saturation but proven high LTV potential (Games). This top-down analysis provides the data to inform that critical decision.

In the next article, we are going to dive deeper into different sub-categories and their distribution strategies.